Table of Content

To help borrowers struggling with mortgage payments due to unemployment or illness, Congress enacted mortgage stimulus programs under the CARES Act and the American Rescue Plan. Fortunately, there are still mortgage relief programs available to homeowners who need them. Those who are suffering financial hardship, directly or indirectly linked to the pandemic, are eligible to enroll in coronavirus mortgage forbearance. It’s also available to homeowners with government-sponsored mortgage loans, such as HUD/FHA, VA, USDA, Fannie Mae and Freddie Mac. For homeowners struggling with their mortgage payments, it’s a wise time to refinance.

Your current forbearance options depend on what type of mortgage loan you have, and whether you’ve used a forbearance plan previously. Many lenders are offering forbearance for as long as Covid is considered a National Emergency. And thousands of homeowners are still eligible to refinance despite rising rates.

State and Federal unemployment assistance

And similar programs, including Fannie Mae’s HIRO and Freddie Mac’s Enhanced Relief Refinance, were also discontinued. With the impact of Covid waning, Congress has wound down much of its Covid-era mortgage stimulus. ARP money is already on track to secure permanent housing for more than 100,000 people through the end of 2022, the White House said. The Biden administration announced its plan to cut US homelessness by 25% in 2 years.

State regulations must follow its prescriptions, said Robert Howarth, a Cornell University professor and a member of the Climate Action Council. For existing homes, residents whose fossil fuel-burning heating units give out after 2030 will have to replace them with a zero-emission system. For the last year, Chris’ restaurant has been struggling to keep its doors open. They have been left out of previous PPP loans parameters and are now at risk of closing permanently without immediate support.

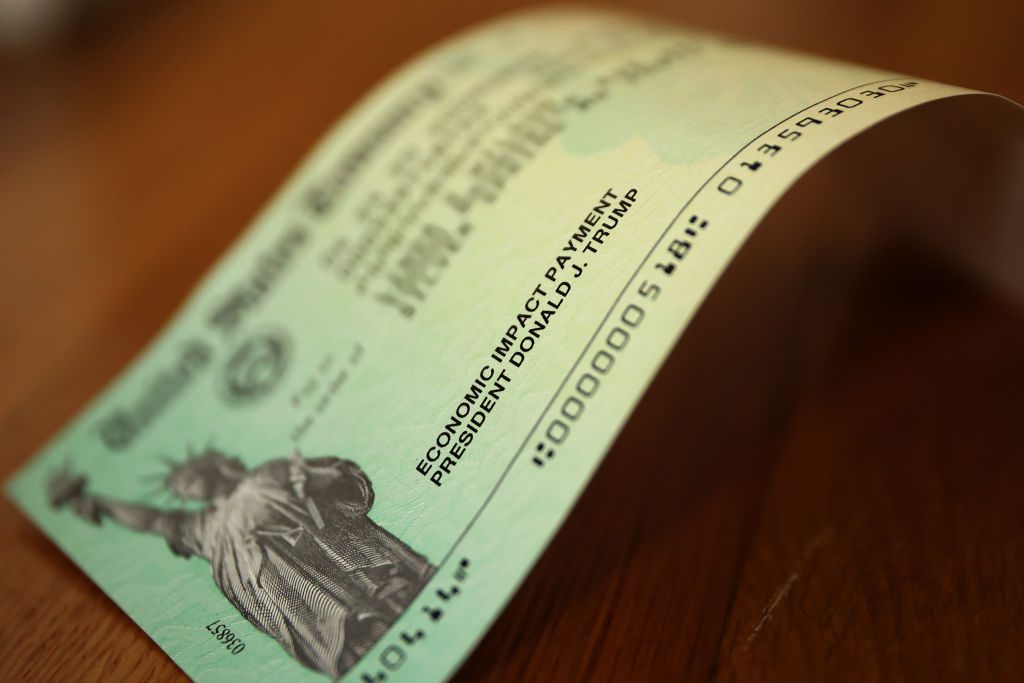

U.S. Department of the Treasury

Plus, we revealhow to lower mortgage paymentsas interest rates rocket. If you get accepted, the funds can be used formortgagepayments, homeowner’s insurance, utility payments, and more. To qualify, homeowners must have a mortgage balance of less than $548,250 as of 2021. They also must have suffered a financial hardship, such as a job loss, after Jan. 21, 2020, shortly before the coronavirus pandemic forced an unprecedented shutdown of the nation's economy. The policy proposals currently focus on creating jobs and supporting families, but many are hopeful that additional stimulus checks and student loan forgiveness will also make the cut.

The others have so far set up pilot programs, or remain in the process to do so, according to the National Council of State Housing Agencies . To apply for the aid, eligible individuals should contact their state housing agency. Quotes displayed in real-time or delayed by at least 15 minutes. It should be noted, however, that this tax exemption doesn’t apply to state taxes in every state. "This new clarification from the IRS is good news for the millions of taxpayers impacted, but may still be confusing," Mark Steber, chief tax officer for Jackson Hewitt, toldCNET.

Do you qualify for a lower interest rate?

$30 million is also available for the territories of Guam, American Samoa, the U.S. Virgin Islands and the Commonwealth of the Northern Mariana Islands. If you are owed money thanks to this tax exemption and due to having already completed your tax return, the IRS will send you the money automatically.

The housing crisis has been amplified by the pandemic, with housing advocates warning that the previous stimulus packages weren’t enough. “President Biden is committed to protecting homeownership and housing stability as America begins to turn a painful crisis into a robust recovery,” the White House said in a statement. A foreclosure moratorium averts the worst possible consequence for a homeowner with missing payments.

Importantly, your loan servicer cannot ask you to repay everything as a lump sum right after exiting forbearance. It’s more likely you’ll pay the missed amount in installments along with your regular mortgage payments or defer repayment until you sell the home or refinance. You can also use this lookup tool from the Consumer Financial Protection Bureau to find active mortgage relief programs in your area. HAF funds are allocated state by state, and it’s up to state administrators to distribute the funds to individual homeowners who qualify for aid.

The scoping plan approved today will likely continue to make news. The meeting of the Climate Action Council was still going on as this report was published. To promote the use of heat pumps, the state is implementing significant financial incentives. Very few residences are heated now with high-efficiency heat pumps.

This is for people who have not owned a home within three years. The income requirements are that you can't make more than 75,000 for a single person and $150,000 for a couple. This program provides a tax credit of 10% of the value of the home or up to $8,000. This is a refundable tax credit, too, which means you don't have to owe that much to benefit from it. The home must have been purchased between January 1, 2009, and December 1, 2009, to qualify. For those who almost got under the deadline, there are some tax credits for those who purchased between April and December 2008.

Select programs, like the government-backed Streamline Refinance, can help borrowers refinance with little, no, or negative home equity. The right one for you will depend on your current financial situation. He also approved of the president's intent to pay for housing, healthcare, and help people obtain work and benefits, which Berg said has had the most "positive impact" on homelessness over the last two decades. The three stimulus checks paid out so far – one in March 2020, one in December 2020, and one in March 2021 – have so far amounted to $3200 in direct cash relief to all American adults within certain income brackets.

No comments:

Post a Comment