Table of Content

To get help right away, click here for more information about Obama's home stimulus package. Homeowners aremissing out on savings worth more than $300 per monthby not refinancing their mortgage. To apply, check your state's website and follow the instructions. Plus, the homeowner’s mortgage balance must be less than $548,250. You may be eligible if you experienced financial difficulties after January 21, 2020, as well as hardship that began before this date but continued after. The HAF provides a minimum of $50 million for each state, the District of Columbia and Puerto Rico and $498 million for Tribes or Tribally-designated housing entities and the Department of Hawaiian Home Lands.

This is for people who have not owned a home within three years. The income requirements are that you can't make more than 75,000 for a single person and $150,000 for a couple. This program provides a tax credit of 10% of the value of the home or up to $8,000. This is a refundable tax credit, too, which means you don't have to owe that much to benefit from it. The home must have been purchased between January 1, 2009, and December 1, 2009, to qualify. For those who almost got under the deadline, there are some tax credits for those who purchased between April and December 2008.

Other Government Sites

When homeowners default on their FHA loan, HUD takes ownership of the property, because HUD oversees the FHA loan program. These properties are called either HUD homes or HUD real estate owned property. Refinancing your mortgage allows you to pay off your existing mortgage and take out a new mortgage on new terms. You may want to refinance your mortgage to take advantage of lower interest rates, to change your type of mortgage, or for other reasons. So whether you need mortgage relief or reassurance about health matters, be sure to choose trustworthy sources — and to ask for help as soon as you think you’re going to need it. The National Low Income Housing Coalition has a lookup tool that can help renters find state and local assistance.

Importantly, your loan servicer cannot ask you to repay everything as a lump sum right after exiting forbearance. It’s more likely you’ll pay the missed amount in installments along with your regular mortgage payments or defer repayment until you sell the home or refinance. You can also use this lookup tool from the Consumer Financial Protection Bureau to find active mortgage relief programs in your area. HAF funds are allocated state by state, and it’s up to state administrators to distribute the funds to individual homeowners who qualify for aid.

Money tight because of COVID-19? These relief programs can help

Click on the agent tab to find contact information to learn more about the property. If you have a complaint about an FHA loan program,contact the FHA Resource Center. Be sure to watch for aggressive lending practices, advertisements that refer to the loan as "free money," or those that fail to disclose fees or terms of the loan. If your loan is backed by the FHA, VA, or USDA, you’re also protected until at least July 31, 2021.

Similar to the previous two stimulus checks, single taxpayers who make less than $75,000 will receive the full $1,400. The stimulus check now phases out for single taxpayers making more than $80,000 of adjusted gross income, which was previously set at $100,000. Biden’s stimulus package pushed the deadline to apply for a forbearance program to June 30, 2021, for those holding a HUD/FHA, VA or USDA mortgage. If homeowners have loans with Fannie Mae or Freddie Mac, then there is no deadline.

Federal Financial Data

The opinions expressed are the author’s alone and have not been provided, approved, or otherwise endorsed by our partners. If you test positive for Covid-19, you may need to change your holiday plans. The Centers for Disease Control and Prevention now recommends isolating for at least five days, even if you only suspect that you have the virus. The winter Covid-19 preparedness plan is the Biden administration’s effort to curb the anticipated spread of Covid during the winter holidays. Treasury published resources to support Tribal Governments submitting HAF Plans including a recording and slides. Treasury published a resource to support HAF Programs Collaborate with Servicerson November 18, 2022.

If you think you might benefit from the Homeowner Assistance Fund, reach out to your loan servicer to talk about whether you’re eligible. Per the Treasury Department, each state received at least $50 million from the fund; however, the states which received the most were California ($1 billion), Florida ($676 million) and Texas ($842 million). For homeowners who haven’t been able to pay their mortgage due to financial hardship, the bill calls for funds to be set aside for legal assistance in a foreclosure.

Learn more about how to file for unemployment insurance at the U.S. The American Rescue Plan extended unemployment benefits until September 6 with a weekly supplemental benefit of $300 on top of the regular $400 benefit. Track the status of your payment with the Internal Revenue Service’s Get My Payment Tool. Those with dependents will receive $1,400 per person, including college students and seniors claimed as dependents. The Treasury Department is providing critical assistance to small businesses across the country. Use theHUDHomestore to find listings of HUD real estate owned properties for sale.

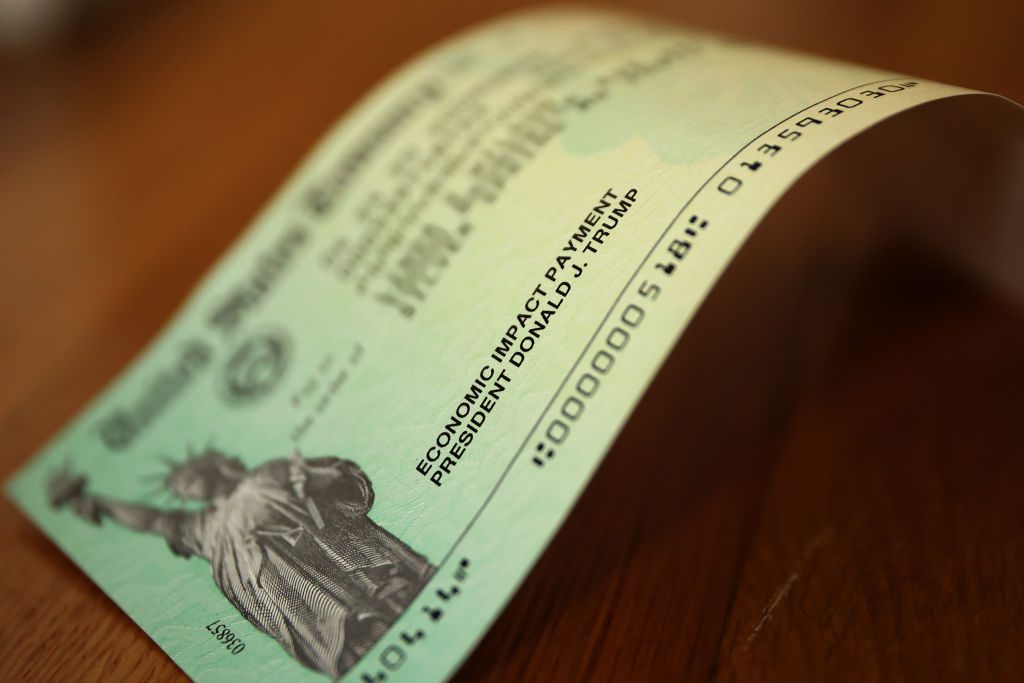

Data shows that high inflation, rent spikes that are only starting to fall off, and an unaffordable housing market have all contributed to rising homelessness in the US. The Treasury Department, the Office of Fiscal Service, and the Internal Revenue Service provided three rounds of fast and direct relief payments during the various phases of the COVID-19 crisis. Payments from the third round continue to go out to Americans across the country. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it.

The administration is encouraging Americans to use the tests before traveling or visiting indoors with people with compromised immune systems. Homeowners canfind out what homeowner assistance covers, how it works, and who’s eligibleon the interagency housing portal hosted by the Consumer Financial Protection Bureau . If and when your application is approved, the funds are typically sent directly to your mortgage lender and other providers.

And loan modification may be available to those with longer-term relief needs. By lowering your mortgage interest rate and/or extending your loan term, you can typically reduce your monthly payment and take some pressure off your budget. When most people think of government or Congress mortgage relief, they’re thinking of HARP — the Home Affordable Refinance Program. HARP was a government program rolled out by the Federal Housing Finance Agency in 2009. For nine years, it helped millions of homeowners refinance after being hard hit by the housing crisis.

And the number of underwater borrowers shrunk to just 2% of the market. If you’re not sure whether a refinance is right for you, you might take advantage of the other VA relief program. Fannie Mae’s RefiNow and Freddie Mac’s Refi Possible are designed for low- to moderate-income homeowners.

No comments:

Post a Comment